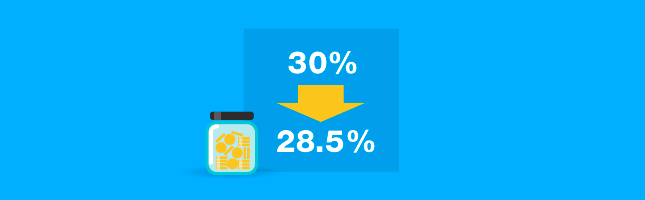

For your 2016 tax return, the small business company tax rate has been reduced from 30% to 28.5%. This lower rate also applies to small businesses that are corporate unit trusts and public trading trusts.

If you complete your own company tax return, use the new rate of 28.5% when working out the ‘Tax on taxable or net income’ (T1) in the ‘Calculation statement’.

The franking credit cap remains unchanged at 30% (even if you are eligible for the reduced company tax rate of 28.5%).

You are a small business if you are a sole trader, partnership, company or trust that has an aggregated turnover less than $2 million.

from: https://www.ato.gov.au/Newsroom/smallbusiness/General/Small-business-company-tax-rate-cut/?sbnewsGN20160824